Cat Bonds

• Catastrophe bonds (“Cat Bonds”) are a form of insurance-linked security used to finance peak, non-recurrent insurance risks, such as hurricanes, tropical storms and earthquakes.

• Cat Bonds are the most common form of insurance-linked security and have grown in response to hard reinsurance markets and demand from specialist cat bond funds.

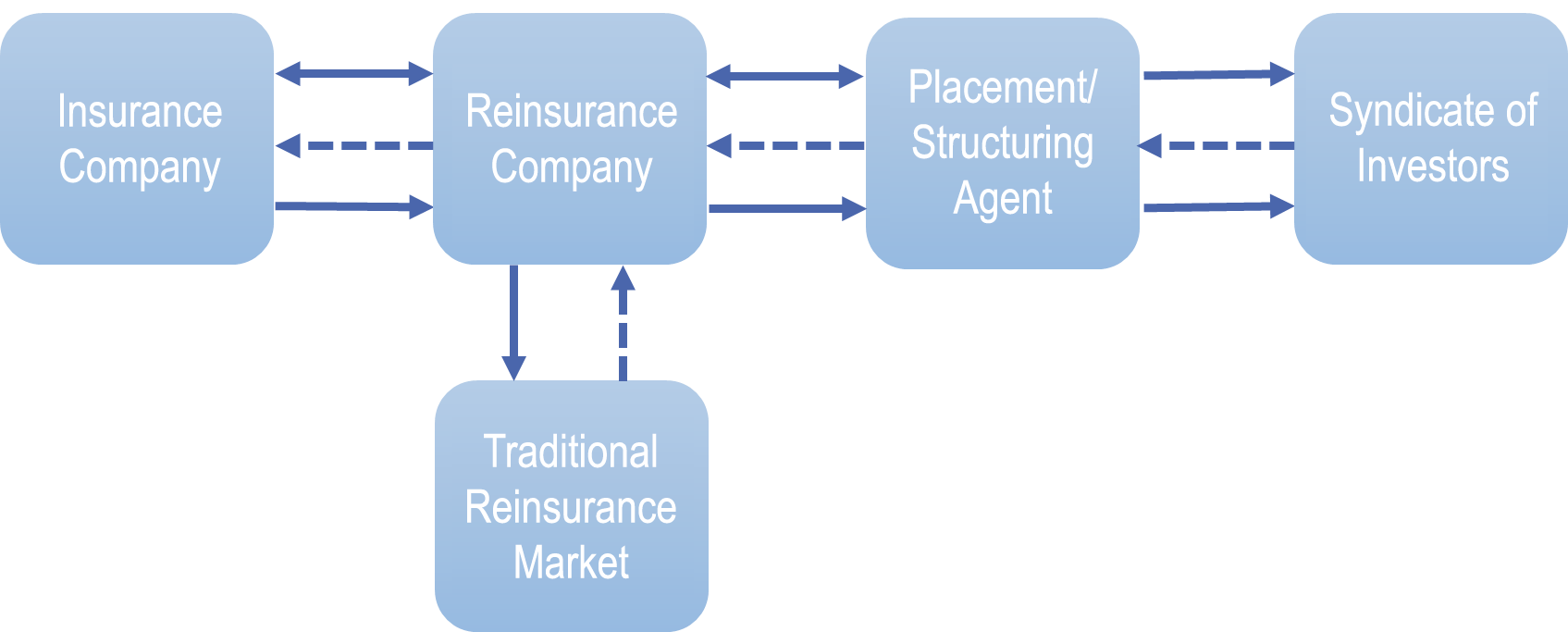

• Cat Bonds are offered directly to capital markets, reducing cyclicality and expanding the risk bearing capacity of the reinsurance market.

• Cat Bonds are structured finance products that aim to isolate pure insurance risk from credit risk and other types of market risk and transform this risk into a capital markets form.

• Cat Bonds are attractive from an investor perspective because they are a non-correlated asset class and the yield is much higher than similarly rated corporate bonds. They do, however, require special expertise to analyse and tend to suffer a complete loss upon default.

• A Cat Bond is a high-yield bond that contains a trigger that may cause the principal payment due on the bonds to be forfeited if a qualifying loss is caused by a specified peril, such as a hurricane or earthquake.

• For a loss to qualify, it should occur at a particular location, exceed a damage threshold or might need to result from multiple events.

• The trigger style may be

- Indemnity

- An indemnity trigger is based on the actual loss to the sponsor

- Parametric

- Parametric triggers are based on event characteristics derived from meteorological data and other third party sources

- Industry-wide loss

- Index triggers are based on industry estimates of loss

- Modelled

- Modelled triggers are based on an industry loss model determined by running event parameters through the modelling firm’s database of industry exposures